Table of Contents

ToggleIntroduction

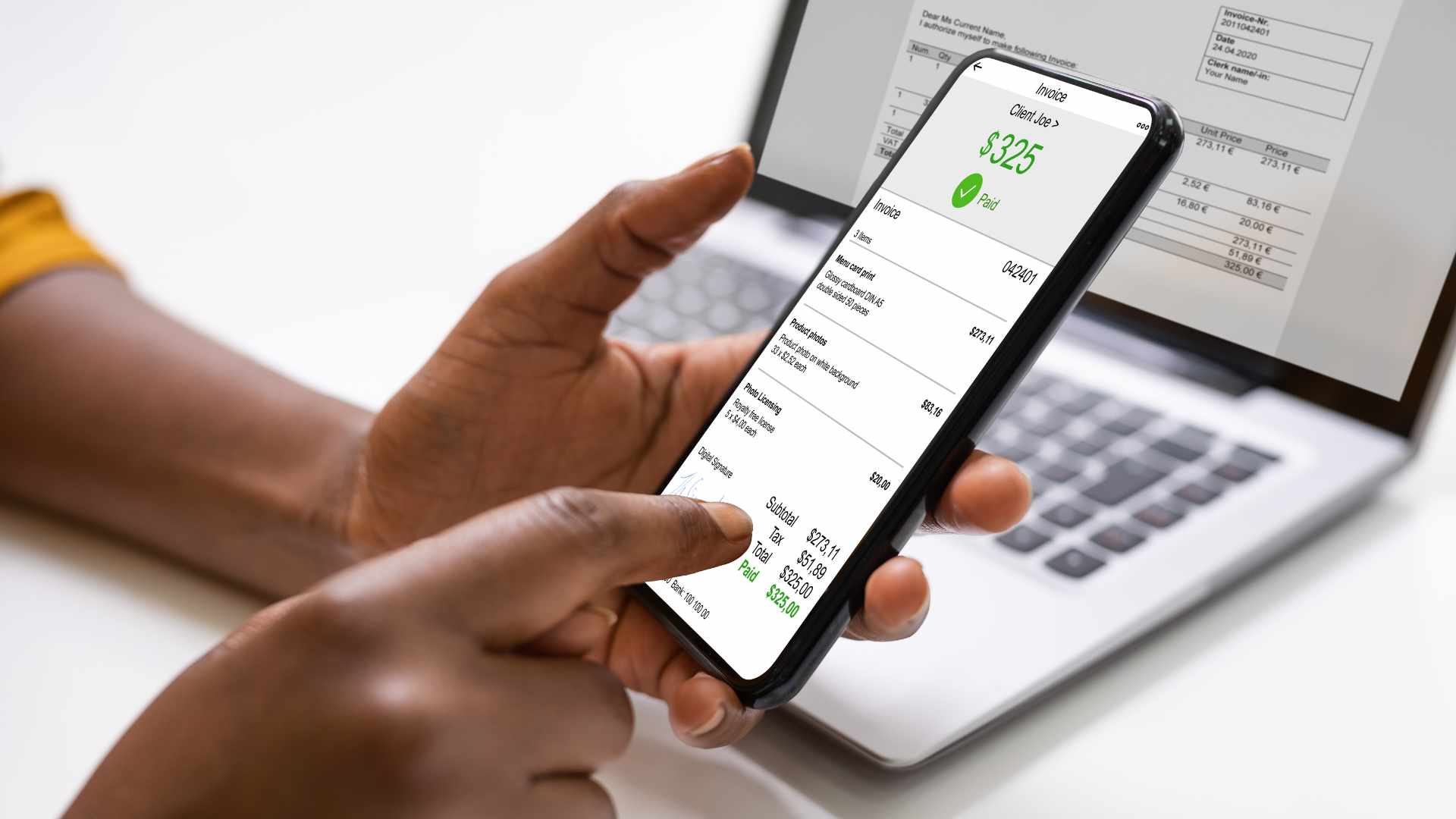

Digital invoicing solutions are becoming increasingly important for small businesses in Kenya, as traditional methods often lead to inefficiencies, errors, and increased costs. Telvoip’s invoicing solutions streamline the entire process by automating tasks like invoice creation and payment tracking, enhancing operational efficiency and reducing human error. This is particularly important for small businesses, where cash flow is critical for maintaining operations and fostering customer relationships.

The ability to issue invoices quickly and accurately helps businesses get paid on time, improving their financial health. As competition in the Kenyan market grows, SMEs can leverage digital invoicing solutions to maintain a competitive edge and focus on core business activities. Adopting such technology is a strategic move that supports better cash flow management, operational efficiency, and improved customer satisfaction.

Improved Cash Flow Management

Digital invoicing solutions are crucial for small businesses, especially in competitive environments like Kenya, to maintain a steady cash flow. These solutions automate the invoicing process, ensuring invoices are generated and sent promptly, minimizing billing delays. Automatic payment reminders reduce the time it takes to receive payments from clients, accelerating cash cycles. Real-time tracking of invoices allows businesses to quickly identify late payments, enabling proactive resolution before they escalate. This level of oversight helps meet financial obligations, facilitates better financial planning, and invests in growth opportunities.

Digital invoicing solutions are crucial for small businesses, especially in competitive environments like Kenya, to maintain a steady cash flow. These solutions automate the invoicing process, ensuring invoices are generated and sent promptly, minimizing billing delays. Automatic payment reminders reduce the time it takes to receive payments from clients, accelerating cash cycles. Real-time tracking of invoices allows businesses to quickly identify late payments, enabling proactive resolution before they escalate. This level of oversight helps meet financial obligations, facilitates better financial planning, and invests in growth opportunities.

Cost Savings and Efficiency

Cost savings and efficiency are critical advantages of adopting digital invoicing solutions for small businesses. Traditional invoicing methods incur significant costs related to paper, printing, postage, and storage, which can quickly accumulate and strain limited budgets. Transitioning to electronic invoicing allows businesses to eliminate these expenses entirely, enabling them to allocate resources more effectively. Moreover, the speed of digital invoicing accelerates the billing process, as invoices can be sent instantly without the delays associated with physical delivery.

This efficiency extends beyond cost reduction; it also streamlines administrative tasks, significantly cutting down the time spent on invoicing-related activities. As a result, small business owners and their teams can redirect their efforts toward more strategic initiatives, such as enhancing customer relationships, exploring new markets, or improving product offerings.

Improved Efficiency

Automating the invoicing process with these systems eliminates the potential for human error that often affects manual methods. With digital invoicing, billing details are captured accurately, and invoices are generated without the risk of mistakes in calculations, item descriptions, or client information. This accuracy is crucial for maintaining positive relationships with clients, as it minimizes the likelihood of disputes or delayed payments due to incorrect invoices.

Moreover, accurate invoicing enables small businesses to maintain a professional image and build trust with their customers. Adopting digital invoicing solutions enables Kenyan SMEs to enhance their overall financial management and focus on delivering quality products or services, free from the burden of manual invoicing errors.

Easier Tracking and Reporting

Centralized invoicing systems significantly enhance the ability of small businesses in Kenya to track and report on their financial performance, offering a level of oversight that manual methods simply cannot match. With these digital solutions, businesses can easily monitor outstanding invoices, allowing them to identify which payments are overdue and take appropriate action to follow up with clients. This capability not only helps in maintaining a healthy cash flow but also aids in financial planning and forecasting.

Centralized invoicing systems significantly enhance the ability of small businesses in Kenya to track and report on their financial performance, offering a level of oversight that manual methods simply cannot match. With these digital solutions, businesses can easily monitor outstanding invoices, allowing them to identify which payments are overdue and take appropriate action to follow up with clients. This capability not only helps in maintaining a healthy cash flow but also aids in financial planning and forecasting.

Additionally, centralized invoicing systems generate detailed reports that provide valuable insights into various aspects of the business, such as revenue trends, payment patterns, and client behaviors. The ease of tracking and reporting also simplifies compliance with tax regulations and financial audits, as all invoicing data is stored in a single, organized platform.

How Telvoip’s Invoicing Solution Supports Kenyan SMEs

Customizable Invoicing Features

Telvoip’s invoicing solutions offer high customization, allowing small businesses in Kenya to create invoices that accurately reflect their offerings and maintain a professional brand image. These customizable features include setting up recurring invoices for subscription-based services, adding detailed line items for itemized charges, and including personalized messages to clients. This flexibility allows businesses to craft visually appealing invoices that serve as an extension of their brand identity. Telvoip’s attention to detail and adaptability make it an ideal choice for Kenyan SMEs looking to streamline their invoicing processes while maintaining a strong, consistent brand presence.

Seamless Integration with Other Business Tools

Telvoip’s invoicing solutions in Kenya offer seamless integration with accounting software, CRM systems, and payment gateways, synchronizing financial data across platforms. This reduces manual data entry and errors, allowing small businesses to track payments, manage customer relationships, and make informed decisions. This integration not only streamlines the invoicing workflow but also provides a comprehensive view of financial health. This allows SMEs to operate more efficiently and focus on driving growth in a competitive market.

Why Kenyan SMEs Should Consider Switching to Digital Invoicing

Kenyan SMEs should consider adopting Telvoip’s digital invoicing solutions to gain a competitive edge in the market. This technology can drive efficiency, cost savings, and improved cash flow management. Telvoip’s digital invoicing streamlines the invoicing process, reduces errors, and ensures faster payments from clients. This allows SMEs to redirect resources towards strategic initiatives and fuel growth.

Additionally, it is more environmentally friendly, aligning with the growing emphasis on sustainability in business practices. By choosing Telvoip, Kenyan SMEs position themselves for success through enhanced operational capabilities, reduced costs, and improved competitiveness. With Telvoip’s digital invoicing solutions, Kenyan SMEs can modernize operations, strengthen client relationships, and thrive in a challenging market.

Conclusion

Invoicing for small businesses in Kenya is shifting towards digital solutions, aligning with global business efficiency and sustainability trends. Traditional methods risk being left behind, while digital solutions like those offered by Telvoip position businesses for success. Digital invoicing streamlines operations, enhances cash flow management, reduces operational costs, and minimizes errors associated with manual processes.

The Kenya Revenue Authority’s mandatory adoption of electronic invoicing underscores the urgency for SMEs to transition to digital systems for compliance and capitalize on modern technology benefits. By embracing these advancements, Kenyan SMEs can improve their financial health, enhance customer satisfaction, and secure a sustainable future in an evolving economic landscape. The shift to digital invoicing is not just an operational upgrade but a strategic investment that empowers small businesses to thrive in an increasingly digital world.